Table of Content

Also, he needs to apply this online on the GST portal. Lastly the Cookie – is used to store personalized information of the user. Hence, disabling this will not allow the user to log in and perform any transaction in the portal. Further, JavaScript – is used to provide enhanced user experience in using User Interface controls. Therefore, disabling this will not allow a user to perform any transaction in the portal.

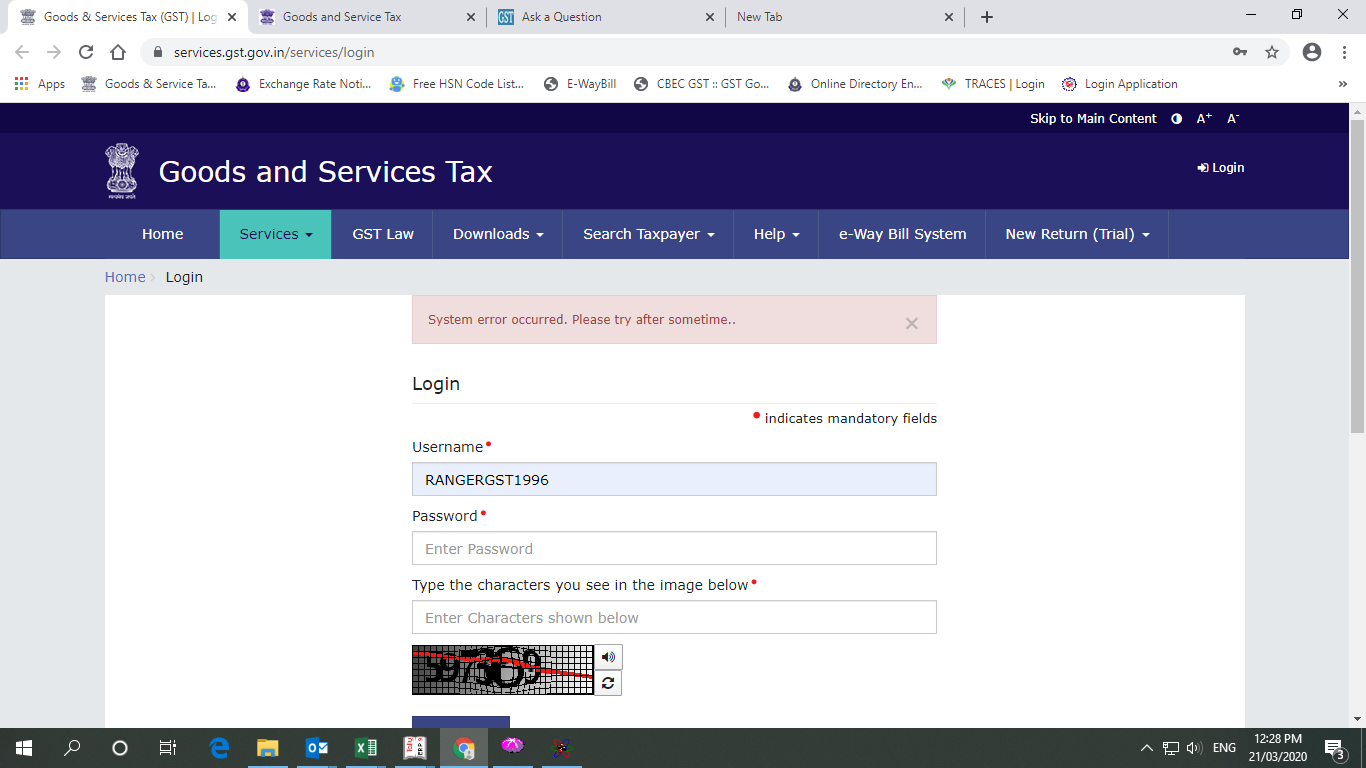

Here are the quick steps to log in to the GST’s e-way bill. Here is the step-by-step guide to login into the GST portal for Existing users. Thereafter the system will send the OTP to the primary authorized signatory. As soon as you enter the OTP, the system will send the username to the registered email id. Log in to the GST Portal with your valid username and password. Now click on the below link provided in the “First-time login” line, which exists below the forgot password link.

Application Status types

Under GST, a person/supplier of goods whose annual turnover exceeds 40 lakhs (10 lakhs for Northeaster states and Hill regions is liable to pay GST. The main reason for the success of the GST Regime is its online portal and services. The common GST Login Portal made the GST filing process reliable, transparent, fast, and secure. In Order to log in to e way bill portal, you must have a valid user id and password.

I) Return Dashboard – Contains all the details about the returns the taxpayer paid and compares liability declined with the ITC claim. This ledger has the details of ITC available to the taxpayer, and this credit can be used to pay off the tax liability. Every time you claim your ITC, it is credited into this ledger.

GST Login Portal – Home Page

Now enter the new username and password as per your choice. Ensure you follow the requirements specified for the new username and password. Whenever you login into the GST Portal for the first time, you will be required to file an amendment application to submit the details of your Bank accounts. There is also an option of ‘refunds’ provided under the ‘Services’ tab. One can use this provision to check the refund application status. The ARN number is a temporary code created while enrolling for GST.

Sales tax could continue to be levied by the states on these products with the overall floor rate. Similarly, the Centre could also continue its levies. After further deliberations, we will issue a final opinion on whether we should keep natural gas outside the GST. Click on ‘File form with DSC’ or ‘File form with EVC’.

Error! Summary for Filing is Not Generated or is Not Available at This Time. Please Try Again Later [Solved]

You may proceed to read the GST portal login for further steps after submitting your online GST Registration application. Under this section on the portal, users will find several links to the Central Board of Indirect Taxes and Customs and states or UTs commercial tax websites. The links host CGST act and rules, SGST act and rules and other acts and relevant GST rules. One can check the latest notifications, amendments and circulars on GST. Help and Guides of GST Tax Payers on GST PortalGST Portal regularly updates this section with new articles and videos to help taxpayers in their GST filing process.

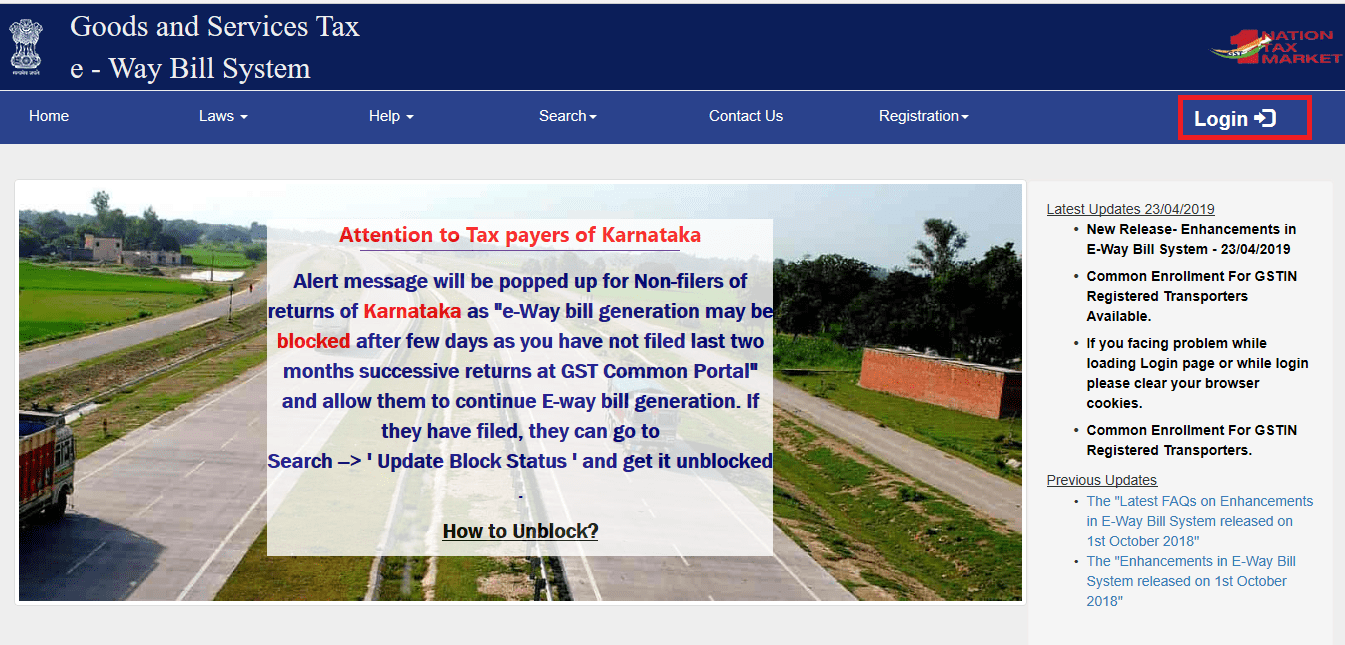

Prior to the implementation of the GST, the generation of waybills were done through state-specific portals, subject to the specified state rules. Yes, GST portal is accessible from anywhere in the world. Please ensure that you access internet from static IP. Please check our article ” How to Login using Temporary Reference Number ” to know how to log into GST with TRN. Now you can reply to show cause notice If you receive it for compulsory withdrawal from the composition scheme. Similarly, Annual Returns preparation tools like GSTR 9, GSTR 9A, and GSTR 9C are also available now on

They can also check the Popular Help Topics section and read about frequently asked questions. The same ‘Downloads’ tab also shows the ‘GST Statistics’ link to view the statistics for different financial years. One can login to GST portal and click on the ‘e-Way Bill System’ option under ‘Services’. MastersIndia stands with you at every step that you may need help and assistance. The next main tab after the Service tab is the GST Law; here, you can get detailed information about the GST Law. This section will handy for the GST practitioner and tax professionals.

Visit the official GSTN portal and click on the ‘Login’ option provided at the top right corner. Enter the new GST login credentials like username and password to view the dashboard. However, it is understandable that a new user shall need a decent amount of prerequisite guidance to get hold of the process and actions.

Using this option, you can claim a refund for the GST you paid by selecting the proper reason for the refund. Vi) New Return – Here, you can select the new type of return you want to file introduced recently. Iv) ITC forms – You can prepare different ITC forms in both offline and online format from here. You can know the government holidays for the GST practitioner and others using this option. In GST, goods are classified by the Harmonised System of Nomenclature code.

You can now successfully login into theGST Portalusing these credentials created. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents. A user needs to register on the GST portal and log in to view the dashboard. Under News – Updates section, users can check the latest news on GST, including any change in due dates, GSTN system updates and any change in the filing processes. Below is the official video of GSTN explaining the GST portal’s Return dashboard.

However, in many cases, you may want to check the status by entering the TRN number. The other options available on gov in portal under ‘Search Taxpayer’ includes the link to search taxpayer who has opted in or out of the composition scheme. One needs to search by entering GSTIN/UIN details or search by state from where registration was done.

Thus, it includes GST registration, Filing GST Returns, GST payment, and applying for a refund. Perform the below steps to track the status of the registration application after logging into the GST Portal using the Temporary Reference Number . If you have not yet applied for GST registration, follow our GST Registration steps to get your GST Registration number. However, before you proceed with GST registration, kindly ensure that you have all the necessary documents for the GST registration of the proprietor.